In that case, the valuation calculation would look as follows: Cost: 2,000 sq. IRR is uniform for investments of varying types and, as such, IRR can be used to rank multiple prospective projects a firm is considering on a relatively even basis. She then plugs these variables into the following formula: Value of property cost - depreciation + land value. Generally speaking, the higher a project’s internal rate of return, the more desirable it is to undertake the project. IRR calculations rely on the same formula as NPV does. IRR is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. With this real estate rental software spreadsheet, you can take charge of your rental properties: -analyze one unit (ie. Internal rate of return (IRR) is a metric used in capital budgeting measuring the profitability of potential investments. NPV is used in capital budgeting to analyze the profitability of a projected investment or project Net Present Value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows. Internal Rate of Return & Net Present Value Explainedĭavide Pio – CCIM, LEED AP – Explains in Part 2 the Internal Rate of Return (IRR) & Net Present Value (NPV) This method of tabulation takes the potential income for the rental property and compares it to the initial investment. A small office building had the potential for generating 185,690 in annual rent if the property had been 100 occupied.

#Rental real estate noi calculation how to

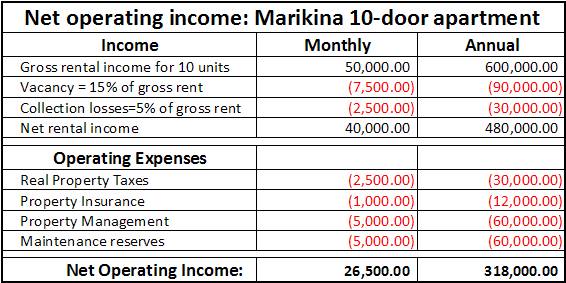

Cash on Cash Return = Annual Cash Flow / Down Payment Net operating income (Potential rental income - Vacancy and credit losses + other income) - Operating expenses How to calculate net operating income (NOI) The following example illustrates the calculation of NOI.

0 kommentar(er)

0 kommentar(er)